06/19/2023

0 Comments

1. As crypto burns, solo bitcoin miner wins BTC ‘lottery’

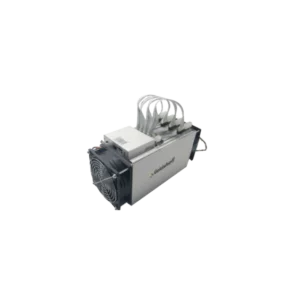

Crypto has been swallowed by a sea of red, but one astronomically lucky bitcoin miner probably hasn’t noticed. A solo bitcoin miner solved block 793,607 on Friday evening using what was likely a single Antminer S9 rig.

“A miner of this size would only solve a block [roughly] once every 450 years on average,” tweeted the admin of mining software Solo CKPool. Unlike regular bitcoin mining pools — in which users combine computing resources to mine together while dividing profits — Solo CKPool is more of a software proxy for those who can’t run Bitcoin Core directly. Instead of sharing profits with all the other miners, Solo CKPool will instead return 98% of bitcoin rewards to the miner (the other 2% going to the admin for upkeep). It’s perfect for tiny setups that might struggle to sync the entire Bitcoin blockchain (now nearly 500 GB), like this $400 rig powered by a Raspberry Pi and a USB mining stick.

But large mining operations can use Solo CKPool too, if they’re feeling particularly fortunate. About 0.21% of Bitcoin’s current hash rate (the total computing power on the network) is using the software right now.

Solo bitcoin mining at all-time high difficulty

Bitcoin miners earn BTC by submitting the correct hash (a string of jumbled letters and numbers) for a particular block. This wins them the right to select and process transactions.

Mining rigs generate as many guesses as possible in the hope that one is accepted — more rigs mean more guesses and more chances at lucrative block rewards (and transaction fees).

Satoshi Nakamoto designed Bitcoin to add blocks about once every 10 minutes on average. So, solving blocks must become more “difficult” as more miners join the network. Otherwise, miners with loads of rigs would solve blocks in much less than 10 minutes.

And there are loads of new mining rigs on the network, including newly-developed ASICs, more efficient than ever before. Bitcoin’s hash rate has in turn set new records all year.

The network’s “difficulty” is also at an all-time high. This figure (now at 51.23 trillion) effectively determines the range of potentially correct hashes, making it less likely that miners would submit the correct ones without adding more machines.

All this makes mining bitcoin with a single — or even a handful — of rigs really special. Over the past six months, data suggests only eight blocks have been solved by Solo CKPool miners, and fewer than 300 since 2014. That works out to be roughly 0.03% of all blocks mined across both periods. Two blocks were amazingly solved across consecutive days last January, also believed to be by garage miners. As for our recent winning solo miner, they seem content with holding their winnings. Blockchain data shows they’ve sent the BTC to a fresh address, where it still sits.

The SoloCK admin estimated their luck amounted to one-in-5,500 chance. The odds of winning the US Mega Millions jackpot — most recently worth $240 million — is currently around one in 303 million.

2. HIVE Blockchain: A Potential Legacy Bitcoin Miner In The Making

The Becoming of A Legacy Bitcoin Miner

About a year ago in July 2022, HIVE Blockchain (NASDAQ:HIVE) was our prime go-to crypto mining company to invest in. It had many advantages over other Bitcoin mining companies. It operates with 100% renewable energy, sub $20,000 total mining cost per Bitcoin (including all business costs), growing Bitcoin (BTC-USD) and Ethereum (ETH-USD) reserves, attractive valuations (trading below adjusted net asset value, NAV), and more. The only major risk we identified was ‘The Merge’, which is Ethereum’s transition to Proof-of-Stake (‘PoS’). Hence, we maintain our strategy to HODL Bitcoin.

Although ‘The Merge’ was imminent, Ethereum’s transition had been delayed for many years. There was no saying how long HIVE can enjoy the high margins from mining Ethereum. Then 2 months later in September, Ethereum’s pivot to PoS is completed. Still, HIVE was adamant about optimistic opportunities to mine other Proof-of-Work (‘PoW’) coins and tokens should Ethereum switch to PoS. We studied and outlined 3 ways we expect HIVE to navigate. So it will be interesting to see how has HIVE fared since ‘The Merge’.

HIVE’s Post-Merge Bitcoin Production

On a high level, Bitcoin production is a function of 2 things: mining capacity and Bitcoin network hash rate (or mining difficulty). We predicted that the production (revenue) will decline by more than 32% due to the mining difficulty differential between Bitcoin and Ethereum.

In 2022Q4 and 2023Q1, HIVE’s Bitcoin production fell by 43%, 10% more than our estimation. In this sense, the 10% additional decline can be attributed to the increase in Bitcoin mining difficulty. HIVE also seemed to agree. In all of HIVE’s monthly updates in 2022Q4, HIVE seemed very conscious about the mining difficulty of Bitcoin to attribute the decline in Bitcoin production to the increased mining difficulty.

But when mining capacity increased in 2023Q1, HIVE no longer mentioned mining difficulty. We just think that HIVE could be more explicit in attributing the decline in production to mining capacity (Table 1) as well.

Referring to Table 1, HIVE’s production has yet to recover to the pre-Merge level. We think that it is unlikely for HIVE to regain the pre-Merge production level anytime soon. On one hand, the Bitcoin mining difficulty has been increasing by 93% annually since 2021H1. On the other hand, HIVE missed its mid-2023 6.2 EH/s target, and may not have the balance sheet to expand willfully.

Note that HIVE used the term ‘equivalent hashrate’, meaning the 6.2 EH/s target also includes Ethereum mining capacity. Since the Ethereum mining capacity is worth less in terms of Bitcoin-equivalent capacity post-Merge, 2022Q3 and 2022Q4 saw a 40% drop (2.06 / 3.4 EH/s, Table 1) in mining capacity. It is not until May that HIVE recovered pre-Merge mining capacity. Even so, Bitcoin production remains below pre-Merge levels due to the increase in mining difficulty. Hence, HIVE’s concern about increasing mining difficulty is well justified.

In June 2023, HIVE resumed its 6 EH/s year-end target. Whether HIVE can realize this target remains to be seen. HIVE currently has $8.6mil in cash and $15.7mil in deposits. We previously estimated that it requires $23mil to add 1 EH/s of mining capacity. Hence, adding another 2.7 EH/s would require about $46mil. Hence, we do not think that HIVE has the balance sheet to meet this expansion target at the moment. Else, we expect to see an increase in liability or outstanding shares (about 13%). In any of the 3 cases, shareholder value will decline.

3. A West Texas lab’s mission to make cryptocurrency mining sustainable

Cryptocurrency has the potential to revolutionize our monetary system. Bitcoin — the largest cryptocurrency — could provide people with a more secure, difficult to counterfeit, more streamlined, and decentralized financial system.

But as bullish as people are on Bitcoin, there’s been a difficult-to-ignore shadow looming over the industry.

“Bitcoin is one of the most exciting and fascinating technologies,” says John Belizaire, the CEO of Soluna Computing, which buys unused clean energy to sell to others who need it.

“But it has this detrimental side effect, or this bug” — the bug he’s referring to is Bitcoin’s energy consumption.

But there is potential to make this promising technology greener — and Lancium, a Texas-based database management company that designs smarter and greener data centers is looking to make Bitcoin greener in a big way. They’re building the single largest Bitcoin mine in North America — and Lancium says it will be the most sustainable, as well.

How much energy does Bitcoin use?

All cryptocurrency transactions — as well as the release of new coins into circulation — are recorded through a process called mining. This process requires many verified crypto miners to validate a transaction by solving incredibly difficult mathematical puzzles.

This acts as a way to verify all transactions in a decentralized manner — but, because Bitcoin mining requires a lot of computing power, it uses a decent amount of energy.

When the numbers hit the media, they were startling: Bitcoin’s energy consumption could be more than twice the amount of energy it took to mine copper or gold, researchers at the Oak Ridge Institute announced in 2018. Further studies out of Cambridge University found that the Bitcoin carbon footprint was on par with that of smaller countries like Argentina.

The questions around just how damaging Bitcoin energy consumption was to our chances of reversing climate change perhaps hit their peak around May 2021, when Elon Musk reversed his position on allowing customers to buy Teslas with the cryptocurrency, citing the Bitcoin carbon footprint as his reason.

Reducing Bitcoin energy consumption

Renewable energy can fit the bill when it comes to cheap electricity. But it is not necessarily the most efficient form of power yet.

“Renewable energy is the future,” says Michael McNamara, the CEO and co-founder of Lancium. And Lancium’s guiding principle is that the transition to greener power is going to happen faster than people think.

“Our increase in power consumption can have a carbon negative impact,” McNamara says, “by enabling more renewables faster, and retiring fossil plants faster as well.”

Lancium’s idea was to move power-hungry data centers away from the users, and to where the energy is at its source.

And that source is West Texas.

“It’s abundant with wind, and it’s abundant with solar,” says Shaun Connell, executive vice president of power for Lancium.

But, Connell says, there’s a problem: you can’t store wind and sunshine.

To help solve this problem, Lancium has begun to build and operate a set of massive data centers.

By pulling from the energy reserves created by renewable sources like wind and solar power when the power grid isn’t being used heavily, Lancium data centers ensure that the clean energy is not going to waste.

When the demand for power is high, the data centers do the opposite, throttling down their energy consumption. By using only renewable power smartly, the centers free themselves from some of the most costly and power-hungry needs of data centers, like HVAC cooling systems.

And they’re applying this whole approach to a new field: Bitcoin mining.

The mine monitors the current condition of the grid, explains Lancium co-founder and CTO Raymond Cline Jr. When it sees that there is more electricity being created than consumed, it can stabilize the grid by turning that extra electricity into Bitcoin energy consumption.

A Lancium mine’s Bitcoin energy consumption can be adjusted up or down within 16 seconds, helping to ensure the most efficient use of clean energy as possible.

That West Texas location provides another challenge, however; that scorching sun doesn’t just juice up the solar panels.

“When you’re doing that in West Texas, the biggest enemy of Bitcoin miners is heat,” says Bo Gibson, the co-founder of Digital Carpenters. To fight that heat, Digital Carpenters have outfitted the mine with immersion cooling technology.

“Right now, the standard in Bitcoin mining is air-cooled,” Digital Carpenters co-founder John Matthews says. Read: inefficient, energy-hungry fans surrounding the hard-computing miners.

Rather than fans, Digital Carpenters’ immersion cooling technology submerges the miner in a fluid — don’t worry, the fluid doesn’t conduct electricity. By allowing the cooling fluid to flow through the miners, they can keep the chips cool in a more efficient way.

“One of the most sustainable sites ever built”

Beneath the bright West Texas sun, the West Texas wind causing the American and Lone Star flags to dance, a line of ceremonial shovels stands in the sand. Fort Stockton is going to be the site of Lancium’s newest Bitcoin mine.

“It’ll be one of the largest single Bitcoin mines ever built,” McNamara tells a gathered crowd, with a focus on smoothing the path to widespread adoption of renewable energy.